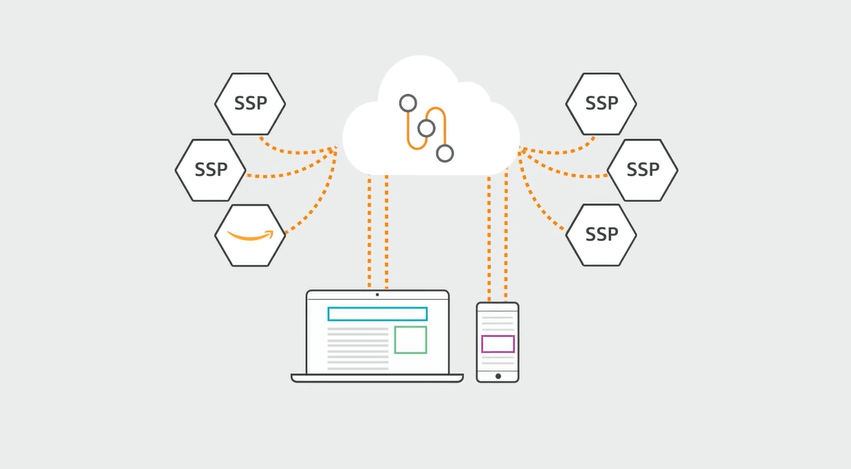

Amazon Publisher Services is a cloud based suit that offers server-side header bidding in form of Transparent Ad Marketplace and Unified Ad Marketplace.

Amazon Publisher Services include Transparent Ad Marketplace (TAM), Unified Ad Marketplace (UAM), and Shopping Insights.

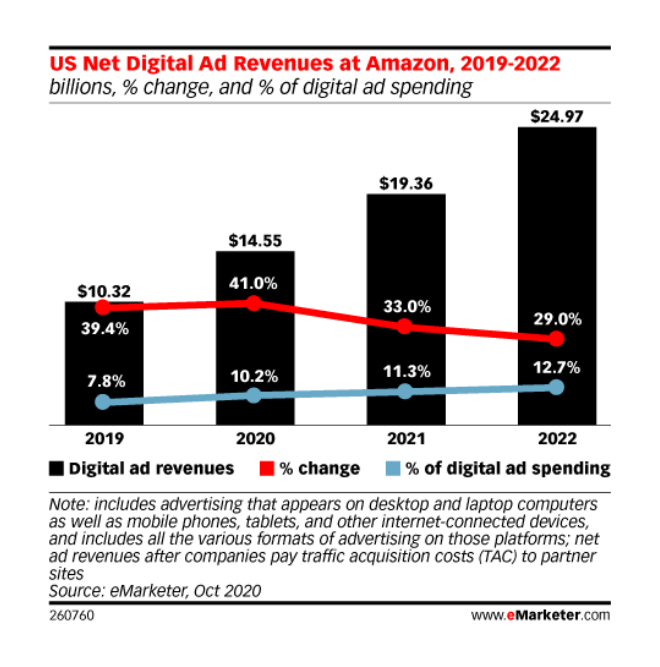

Amazon holds the third rank, after Google and Facebook, on the list of digital advertising platforms by market share. It is predicted to gain a share of 12.7% of the US advertising market by 2022.

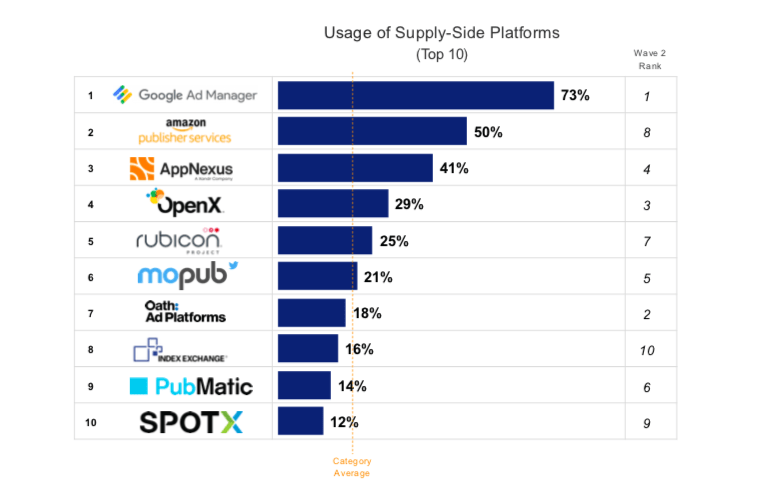

Amazon’s sell-side business moved up from ninth position (in 2018) to second position (in 2019), just behind Google.

This sudden boost tells that Amazon has been successful in offering improved and personalized features and services to its users. On top of that, the ease of use, security benefits, and auction dynamics makes it compete with Google.

Looking at the industry trend – publishers readily adopting Amazon products – we created a quick guide to explain the services offered and their benefits.

Services Offered by Amazon for Publishers

As the name suggests, Amazon Publisher Services (APS) is for web and app publishers to monetize and grow their digital businesses. It is a cloud-based service that brings all the solutions built by Amazon for publishers under one suite. Here are those services:

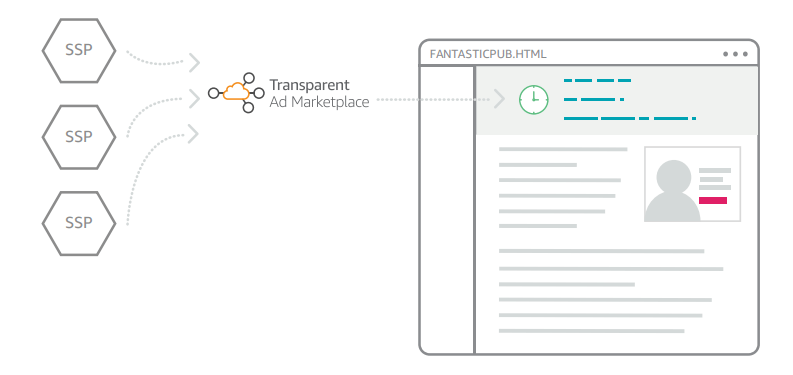

Transparent Ad Marketplace (TAM)

It is a server-side header bidding solution for publishers, similar to Google’s Open Bidding. TAM is designed for enterprise publishers with features like access to direct demand from Amazon and integration with other (publisher-partnered) SSPs.

Here are some key features of Transparent Ad Marketplace:

-

20+ demand partners from Amazon Marketplace including AppNexus, OpenX, RubiconProject, SpotX. Additionally, publishers can bring their own partners and add them to Amazon TAM.

-

Publishers have the ability to turn on and off any bidder from APS portal, without manipulating website code every time.

-

Amazon records time periods for each auction, including bidders who bid for each impression, the bid CPMs and the winner to generate accurate and transparent reports.

-

It supports dynamic display banners and pre-roll video on desktop and mobile web. In-app display and video units require separate SDK integration.

The only technical requirement to use TAM is active integration with the multi-slot header bidding tag of Amazon Publisher Services. Publishers also need a contractual relationship with all demand partners they want to tap into.

Unified Ad Marketplace (UAM)

This service by Amazon is targeted towards small and medium publishers. This is also a server-side header bidding solution that lets publishers manage their ad campaigns. Here are a few benefits of using it:

- It offers solutions for the standard header bidding integration problems like managing multiple contracts and fragmented reporting.

- With Amazon’s single contract and integration feature, publishers can deliver ads from multiple demand partners including Amazon.

- UAM dashboard tracks all the publishers’ earnings from multiple bidders under one panel.

- Publishers can also avoid the hassle of constant changes made to website code by integrating a single code to the website and manage bidder from the Amazon dashboard.

Unified Ad Marketplace is an invitation only plan. Once a publisher is invited to use it, they can follow simple integration steps to make to the dashboard.

Difference Between Amazon TAM and UAM

Both TAM and UAM rely on server-to-server header bidding. However, a key difference between the two is how they handle publishers’ relationships with SSPs.

TAM is ideally for large publishers who have signed contracts with SSPs directly. Amazon doesn’t handle the relationship between the publisher and SSPs, instead the publisher needs to have a good relationship with SSPs beforehand.

In the case of UAM, which is primarily for mid-sized publishers, publishers get access to all the SSPs associated with APS. The contracts with SSPs are signed by APS on behalf of the publishers, after they have signed a contract with APS.

This difference is further reflected in how Amazon handles payments. Publishers using TAM get paid separately by SSPs they have contracts with and by APS for Amazon demand. On the other hand, publishers using UAM receive combined monthly payments from APS.

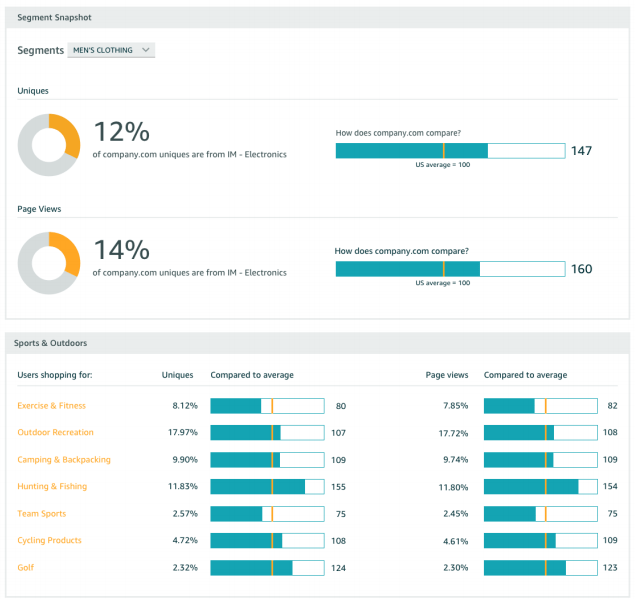

Shopping Insight

Shopping Insight takes a publisher’s website data and its own Amazon customer information (from Amazon.com, the eCommerce service) to match users. This helps publishers know about the products visited by their users on Amazon.

Let’s understand this by an example. Imagine you are a publisher who reviews digital cameras. A lot of camera brands would be interested in putting their ads on to your webpages. To further uplift the value of your inventory, you can showcase your users’ shopping patterns — percentage of users who checked your review and purchased the product. This information can also be used to create better tailored content for your users.

What kinds of insights are available?

- Publishers can create audience segment reports for any domain or page group by unique users and page views.

- Compare these segmented audiences based on inventory performance and advertiser’s involvement.

- These reports can further be compared with the performance of similar (competitor) publishers, both by demographic and by specific shopper audience segments.

What type of data is used for this purpose?

Amazon Shopping Insight completely relies on first-party data. For instance, if your report shows 30% users are from the Electronics segment, this means 30% of your users have searched/browsed for, visited product pages or purchased Electronic products on Amazon.com in a recent time frame.

This service is available for all US publishers having desktop and mobile websites with over 5000 unique visitors per day and are using Transparent Ad Marketplace.

How to Get Started With Amazon Publisher Services

Amazon Publisher Services are currently limited to a few geographies like US. To get started, you need to fill the Contact Form. After submitting it, an Amazon representative will contact you and discuss details.

As mentioned above, not all publishers can use Amazon Publisher Services — it depends on size, niche, geography of the publisher business. Your Amazon account manager will be able to help you better with the services you want. In case you do not qualify to use Amazon Publisher Services on your own, you can try ad networks offering Amazon TAM/UAM (like AdPushup).

Who can work with Amazon Publisher Services?

As mentioned in the previous paragraph, APS isn’t open to work with any or every publisher. Large and mid-sized can leverage this platform, however, it is not suitable for small-sized publishers.

Even when we consider large and mid-sized publishers, there are certain reservations. For example, publishers who wish to use TAM should ideally have contractual agreements with demand partners. Similarly, for mid-sized publishers, UAM is a good platform, but again, it is an invite-only platform, which makes getting access to it hard. UAM is basically for publishers who represent their website and have Google Ad Manager as their ad server.

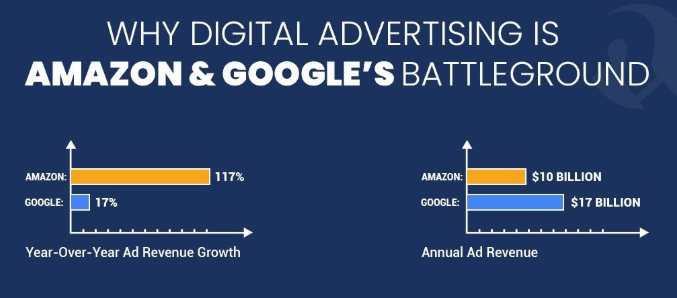

Bonus: Amazon vs. Google

Even though Amazon is new to the advertising industry, its exponential growth shows the company has cracked the code to succeed. But Google’s years of experience helps it retain the first position in the digital ad market.

Amazon’s eCommerce service plays a very important role when it comes to its recent popularity. This is the reason why advertisers get a 10% conversion rate with Amazon, whereas with Google the number is far less — 3.75%.

A recent survey by Digiday showed that advertisers are increasingly directing the search budget to Amazon from Google.

Increase in advertiser’s interest in Amazon is the reason for publishers to start using Amazon services.

While Amazon seems to be winning at ‘product search’ ads (benefiting advertisers, mostly), Google still has a strong grip on programmatic advertising.

Google ranks highly in overall performance, reporting capabilities, ease of use and its ability to root out bad ads and ad fraud. When it comes to sell-side business, Google’s score is always more than Amazon for various services — monetization capabilities, auction dynamics, and fraud prevention.

This is all the more reason publishers and sell-side need to keep using Google for monetization.

While Google and Amazon seem clear winner, let’s not forget that there are plenty of other supply-side platforms available for publishers. And from the recent study, it looks like these other SSPs are just a few percentage behind from these tech giants.

SSPs like AppNexus, OpenX are slowly making their way to the top. While Google and Amazon are known to function inside their walled garden, other SSPs are capturing publishers with their transparent and tailored services.

Coming back the publisher-side, with Amazon Publisher Services, publishers have one more way to integrate to server-side header bidding. And with header bidding, we know, the more the demand, the better the profit. Therefore, Amazon joining the league, along with Google and other SSPs, mean better monetization opportunity.

FAQs

Similar to Google’s open bidding, it is a server-side bidding solution for publishers. Digital ad marketplaces typically have affiliates that larger publishers work with.

With Amazon Publisher Services, you can get solutions built by Amazon. Using our cloud-based marketplace, you can increase revenue without affecting latency. Get direct access to programmatic buyers with no fees.

The Publisher Service refers to any website, application, or service operated by the Publisher that allows Advertisers and their products to be marketed.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.

![Top 12 Ad Networks in India Every Publisher Should Know [2024 Edition] Indian Ad Networks](https://www.adpushup.com/blog/wp-content/uploads/2019/09/undraw_Note_list_re_r4u9-270x180.png)