Bitcoin is back in news again after trading at a record high of $4483 per coin this month. Many cryptocurrencies including Bitcoin are powered by a technology known as blockchain, and its potential use cases extends far beyond just the financial world—it continues to find use in government, healthcare, real estate, security, and many other industries.

At events and in publications that cover the advertising industry, blockchain has been a hot topic as a candidate for bringing in more transparency into ad tech and solving problems such as opaque supply chains and ad fraud, how much of it is hype and what are the facts?

Before getting into how blockchain could help ad tech, let’s understand what it is and how it works.

What is Blockchain?

A blockchain is a growing list of records, or blocks, linked together and secured by cryptography. Stripped to the basics, blockchain is a new way of storing information, with some distinct advantages over traditional information storage and database systems. Every user on the network retains a copy of the entire blockchain at any given point—think of it as a distributed open ledger.

This gives the blockchain permanence, i.e., a user cannot go back and change a record without also changing the copies of blockchain record residing with every other user on the network, making the transaction records largely “tamper-proof”.

Network-wide encryption also makes blockchains secure by design. Moreover, if the information on a few nodes gets corrupted or lost, many other copies exist, lending the system high fault-tolerance.

Keeping these features in mind, the fragmentation, lack of transparency, and fraudulent operations in ad tech such as Methbot are exactly the kind of problems that the blockchain was built to solve.

Blockchain and Gatekeepers

The information economy is characterised by gatekeepers, intermediaries who act as middlemen between any system and its users. Think about banks, investment firms, audit agencies, crypto currency exchanges in the world of money, all of them are engaged in the business of record-keeping. Whenever middlemen enter any system, transparency goes out the window and the chances of fraud increase.

In advertising, the gatekeepers are ad networks, exchanges, and arbitrage agencies who repackage ad inventory and then sell it at a higher price. These players benefit from the opaqueness of the ad tech supply chain and have an incentive in keeping it that way.

How Blockchain Can Fix Ad Tech

Imagine a decentralised ad ecosystem where prices are transparent and all transactions have a immutable and permanent public record. That’s the promise of blockchain.

Today, transactional details about ad deals are stored by independent parties, with neither the publishers nor advertisers have open access to. This has led a lot of disillusionment and backlash from advertisers who are struggling to justify their RoI from programmatic advertising.

Marc Pritchard, Chief Brand Officer at Procter & Gamble, has lately been on a public crusade, speaking at ad events against the murkiness of ad tech.

Better advertising and media transparency are closely related. Why? Because better advertising requires time and money, yet we’re all wasting way too much time and money on a media supply chain with poor standards adoption, too many players grading their own homework, too many hidden touches, and too many holes to allow criminals to rip us off. We have a media supply chain that is murky at best and fraudulent at worst. We need to clean it up, and invest the time and money we save into better advertising to drive growth.

Marc is not the only one. Many other brands are cutting back on programmatic and dropping or switching ad tech partners in the hopes of getting better returns on their ad spend.

Enterprise publishers too are now choosing to build their own ad tech instead of settling for low revenues, badly managed inventory, and the general complexity of outsourcing their ad operations.

In theory, the distributed open ledger of blockchain could be used to open up the ad deals transaction data, making digital advertising more transparent, efficient, and profitable for publishers and brands, something that could go a long way in restoring their lost trust in the medium.

There is already a consortium called AdLedger that aims to be the regulatory body overseeing and advising the implementation of blockchain in ad tech.

This consortium is comprised of like-minded executives working together to harness the potential of a real-time, blockchain-based, peer-to-peer network, lower costs for publishers and increase ROI for advertisers.

While many use cases for blockchain in ad tech still remain in the hypothetical realm, are there any projects that are currently underway? Here are a few.

1: Decentralised Ad Networks and Exchanges

A few companies have already moved with the idea of using blockchain to decentralise the ad tech supply chain. One such network is AdEx which just completed its token sale and raised 40,000 ETH (Ethereum coins worth ~ $11,484,400 at the time of writing this article) to build a decentralised ad exchange based on the Ethereum blockchain. Here’s an excerpt from their whitepaper.

Our aim is to disrupt the existing online advertising landscape and address the significant problems it faces such as advertising fraud, privacy and consent to receiving sponsored messages, and the rise of ad blockers. With digital surpassing all other advertising mediums and accounting for close to 40% of global marketing and ad spend in 2017, we see the need of innovation in this area.

AdEx hopes to solve problems such as lack of bidding transparency, unclear or misleading reporting, ad fraud, ad blockers, and banner blindness among others. Those are a lot of promises to deliver on but they have a strong team that has previously built the streaming video platform Stremio.

Meanwhile, ad network BitTeaser is using the blockchain to deliver ads on standard CPC and CPM models, in which all clickthrough activity can be publicly audited.

The minimum price per click is 5 cents. BitTeaser currently comprises more than 1,000 webmasters, with monthly growth of around 15-20%; some 500 ads blocks (15% monthly growth); average CPC equal to 5.15 cents; and a CTR (clickthrough rate) of 0.45%.

New networks, exchanges, and companies meeting at the intersection of blockchain and ad tech are only expected to go up in number as this is still a relatively unexplored space.

One obvious hurdle is adoption. It’s one thing to release a whitepaper and raise funding, and quite another to get people to actually start using the technology. A point made by Elliot Hirsch, CEO of AdYapper, on Digiday.

The reality is, the industry is still quite archaic. Agencies can’t even figure out how to pay for software that’s not based on a logically flawed CPM pricing model. If they can’t get something that simple figured out, I think we are a long way from using blockchain to cure the ad ecosystem’s ills.

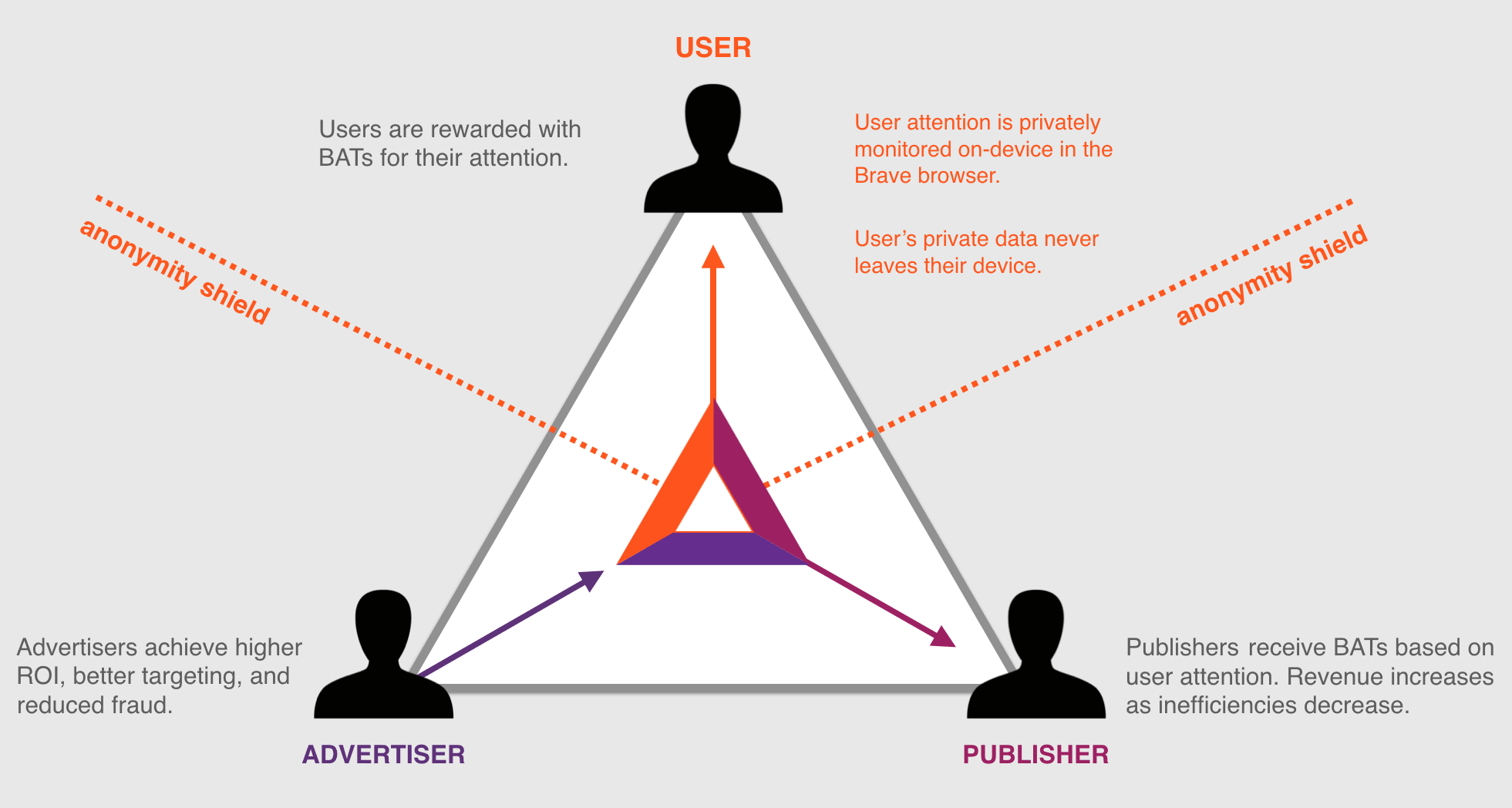

Elsewhere, along with this team, Brendan Eich, founder of JavaScript and Mozilla, and more recently, Brave browser, has also launched something called Basic Attention Token that can be used to purchase ads that will be delivered to users directly in the Brave browser.

Wait a second, wasn’t the entire idea about Brave browser to block ads? It was, but even most ad blocking initiatives focus more on eliminating bad ads and not so much on ads entirely.

Basic Attention Token radically improves the efficiency of digital advertising by creating a new token that can be exchanged between publishers, advertisers, and users. It all happens on the Ethereum blockchain. The token can be used to obtain a variety of advertising and attention-based services on the Brave platform. The utility of the token is based on user attention, which simply means a person’s focused mental engagement.

With these initiatives, Brave is essentially trying to cut through all the middlemen engaged in the buying and selling of ads so that publishers, advertisers, and more importantly, users can benefit.

2. Fraud Detection and Better Reporting

While some are working on a broad solution, others are going after more specific problems. One such problem is ad fraud. According to ad verification company Adloox, businesses could lose over $16 billion dollars this year due to ad fraud, up from an estimated $7 t0 $12 billion in 2016. Clearly, this is a problem that’s not going away on its own.

Colorado-based Rebel AI is using blockchain, encryption, and machine learning to address ad fraud. Its primary offering, called Passport, works by allowing advertisers to encrypt ads and pre-approve intended destinations, the final ad is then decrypted and delivered only if the final destination matches the list provided by the advertiser. This completely roots out the possibility of domain spoofing.

Technical Limitations of the Blockchain

Blockchain is possibly at its peak hype right now, there’s a lot of excitement around the new projects being built using the technology. Still, there are technical bottlenecks that make it fundamentally lacking when it comes to implementing it for running ad operations.

First, the security and peer-to-peer verification of blockchain come at the cost of speed, programmatic and RTB ads are delivered within milliseconds, whereas blockchain transactions can take anywhere between a minute to hours to process, depending on the network and user activity.

Those speeds simply won’t work when it comes to delivering ads online. As explained by Manny Puentes, founder and CEO of Rebel AI, on AdExchanger.

Blockchain’s biggest asset–decentralization–is also its biggest weakness in the digital advertising space. Due to its distributed nature, where transactions are verified by “miners” around the world, blockchain technology simply can’t analyze or process real-time advertising transactions fast enough. Current confirmation times for a transaction to be validated and added to the public ledger range between 10 and 30 seconds.

What’s the solution to this? Faster computing power could speed up the encryption, but then everyone on the network would have to upgrade their hardware—not something that’s likely to happen. You can’t expect everyone from users to ad exchanges to publishers investing in faster computers just to get the blockchain up to speed, and even if they do, it will only be as fast as the weakest link.

Lastly, in a market riddled with tech jargon, the talk of blockchains, encryption, and tokens is not likely to go down well with people who are already disenchanted with things as they are.

Speed and adoption are not necessarily insoluble problems, but they’re obviously big enough to slow down the blockchain revolution as far as digital advertising is concerned.

This is just the beginning, we’ll have to wait and see how some of the projects mentioned above fare in terms of popularity and industry acceptance to know how valuable blockchain really can be to digital advertising. And while it may not be the cure-all for ad tech—it’s already proving its usefulness elsewhere.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.