After April 11, Facebook Audience Network will not support mobile web monetization. Here what it means for web publishers and what they should do.

Starting Apr 11 2020, Audience Network will no longer fill any ad requests to your web and in-stream placements.

FACEBOOK

After April 11, partners will stop getting ad requests for web and in-stream placements. Facebook Audience Network (FAN) has requested its partners to remove the Audience Network from their setups.

Facebook will keep the data and reports of each partner for 6 months post April 11. The final payments will be credited as normal on the 22nd of the month. Meanwhile, the Audience Network will continue working with app publishers.

Why Would Facebook Do This?

Facebook hasn’t clearly explained the exact reason for this change. However, a statement by them states, “we’ve made this decision based on where we see growing demand from our partners, which is in other formats across mobile apps.” Simply put, Facebook wants to focus on mobile apps and pool its resources into them going forward.

In 2019, Facebook CFO Dave Wehner shared Facebook’s ad targeting related ‘headwinds’. He pointed, the major causes of these headwinds are:

- Global privacy regulations (Chrome third-party cookie blocking, GDPR, CCPA, Brazil’s LGPD, and more)

- Facebook’s privacy tools (off-Facebook services)

- Facebook’s product alignment with above norms

This update could be a direct result of recent privacy-related updates rolled by Chrome. Chrome having joined the bandwagon that Firefox and Safari were already a part of presented a greater challenge for Facebook to survive in web advertising.

Additionally, global privacy regulations ask businesses to be transparent when it comes to the usage of user data. Facebook has been reluctant in sharing its business methodologies. It makes sense why Facebook would want to take off from web advertising.

What Was Facebook’s Audience Network Doing Anyway?

FAN was released in 2014. It started as an in-app advertising network for mobile apps. In 2016, the company expanded its services to mobile websites. Basically, with Audience Network, advertisers were able to server ads off-Facebook — on other apps (like TikTok) and mobile websites.

To power FAN, Facebook takes the targeting data from its platforms (Facebook, Messenger, and Instagram) and uses it to show ads on these platforms and off-Facebook platforms.

For advertisers, FAN helped to show targeted ads on Facebook and off-Facebook platforms at a reasonable price. For publishers, it opened up a new way of making money via Facebook’s demand. And for users, it meant Facebook following them across apps and web.

The placements offered by FAN included native, banner, interstitial, rewarded video on mobile devices, in-stream video on desktop and CTV. After April 11, native and banner will only be supported on mobile app platforms, deprecating the rest of the placements.

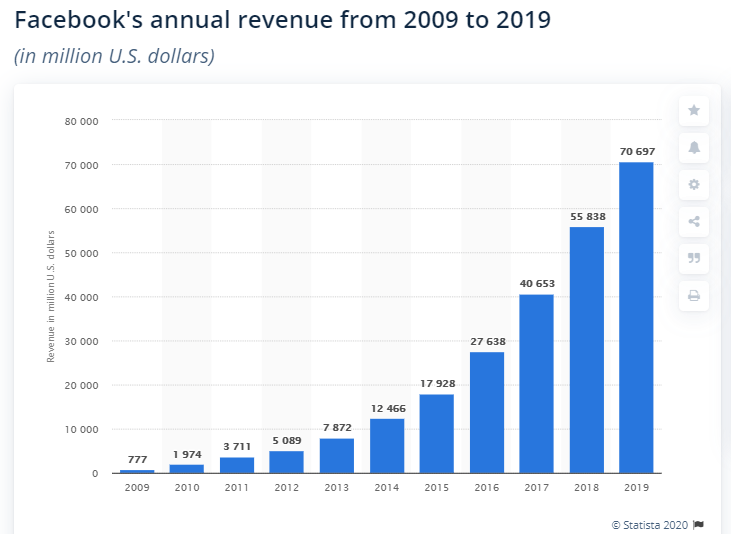

Facebook’s annual revenue for 2019 was $70K million, most of which came from advertising.

In 2018, Audience Network paid $1.5 billion to web publishers and app developers. In the United Kingdom, Facebook’s supply share was 5% – 15% via Audience Network, just behind Google’s AdMob (with 10% – 20%) and Google’s AdX (25% – 35%). Facebook never breaks out its revenue for Audience Network, or the exact split between web and apps. Hence, it is hard to point out how much decline in revenue should be expected by web publishers in the coming days.

But how will web publishers be affected, exactly?

FAN will continue to work for app-publishers. However web publishers will stop getting demands from advertisers using Facebook Audience Network. No demand from FAN means a slight decrease in the number of bid responses and competition on publisher’s inventory. However, this should quickly be handled as giants like Google and Amazon will take on the vacant demand requirement.

How Should Publishers Proceed?

As the news breaks, the demand-side will start updating their campaigns. Most advertisers are likely to turn off their set ups to target web users on publisher’s sites via FAN. Hence, it is no brainer for publishers to wait till April to proceed with the required changes.

Here is what web publishers should get started with to avoid any significant loss after April 11:

- Look for other demand partners:

FAN will stop responding to ad requests for web and in-stream placements. One demand source down means a decrease in competition. In such a case, publishers should get in touch with other demand partners to fill up for this. Similarly, if your demand partner uses FAN, discuss the alternatives with them.

- Remove FAN from waterfall integration:

Since, you will not get any response from FAN for your web inventory, it makes sense to remove it from your code. Publishers should plan out for this change and instruct their ad operation teams to remove it from waterfall integrations and likewise update the ads.txt files.

It is highly likely that the publisher’s performance will fluctuate during the depreciation period. In such a case, getting in touch with other demand partners is a viable solution.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.

![Top 12 Ad Networks in India Every Publisher Should Know [2024 Edition] Indian Ad Networks](https://www.adpushup.com/blog/wp-content/uploads/2019/09/undraw_Note_list_re_r4u9-270x180.png)