For a publisher, calculating the cost per thousand impressions (CPM) is one of the key factors in analyzing a website’s growth. It measures the amount you earn for every thousand impressions on the website.

It is pretty normal to observe fluctuations in CPMs for the whole year, but a significant drop in January is a primary concern for most publishers.

Considering this, publishers have to compromise with their advertising earnings with supply and demand professionals. Hence, they end up with a pretty lower amount compared to their publishing budget.

The phenomenon is called seasonality, and this is among the prominent reasons for the January CPM slump. To know more reasons, proceed further with this blog.

Top 5 Reasons Why CPM Drop in January

As mentioned earlier, there can be several reasons behind the sudden CPM drop in Q1. The most obvious ones include:

1. Holiday Season

The last two months of the year contribute to the holiday season, and publishers have their full focus on online shoppers. Even though this results in high CPM at the end of the year, it certainly drops once the holiday season is over.

2. Reduction in Spending

With the start of the new year, publishers have to rework their campaigns and re-evaluate their budgets. It has a high impact on the overall publishing budget, eventually resulting in lower ad spend.

3. Increase in Ad Inventory

Most publishers tend to increase the ad space available on their websites. As this practice is common, it results in fierce competition among the publishers, and they end up with lower CPM in Q1.

4. Decrease in Traffic

In January, there was a noticeable dip in online traffic when compared to other months. This decline is attributed to the fact that consumers, having already engaged in extensive shopping and product exploration during the preceding two months, tend to reduce their online activities.

This decrease in user engagement directly influences the Cost Per Mille (CPM) rates, as lower traffic levels can result in reduced demand for ad impressions, impacting overall advertising revenues for publishers.

5. Low Demand

CPM is directly proportional to demand, so in Q1, the demand for ads is pretty low and most advertisers are busy curating new strategies for the coming quarters.

Ad sales at this time of year simply reflect the market and there’s not much happening on that front.

“This early in the year, marketers are busy reviewing strategies, planning campaigns, and generally trying to keep up with the mountain of work that’s piled up during the holidays,” says Sanjot Singh, Associate Director of Programmatic Partnerships at Affle. “When there are fewer buyers bidding with scrapes that survived the year-end/holiday season media-buying blowout, more inventory is available per dollar. Consequently, the CPMs drop to pennies and fill rates are abysmal.”

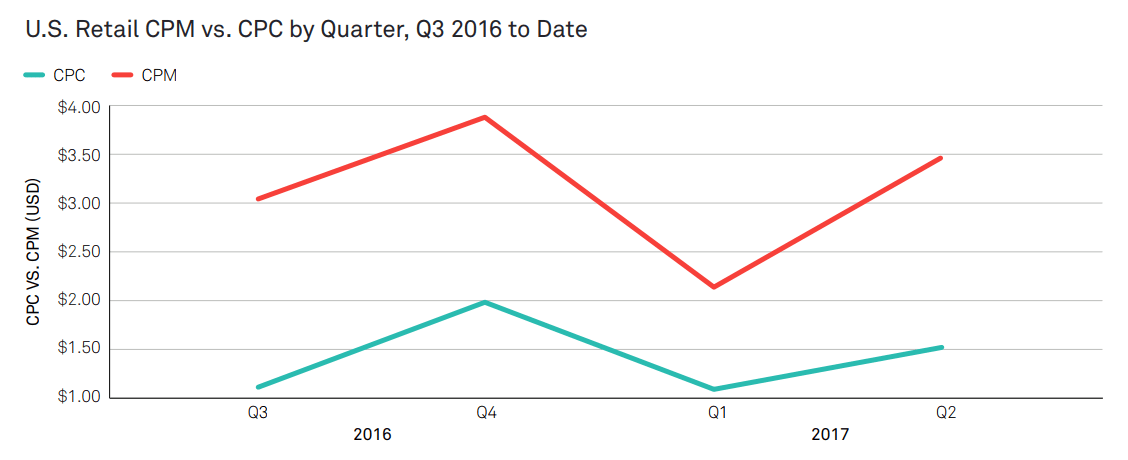

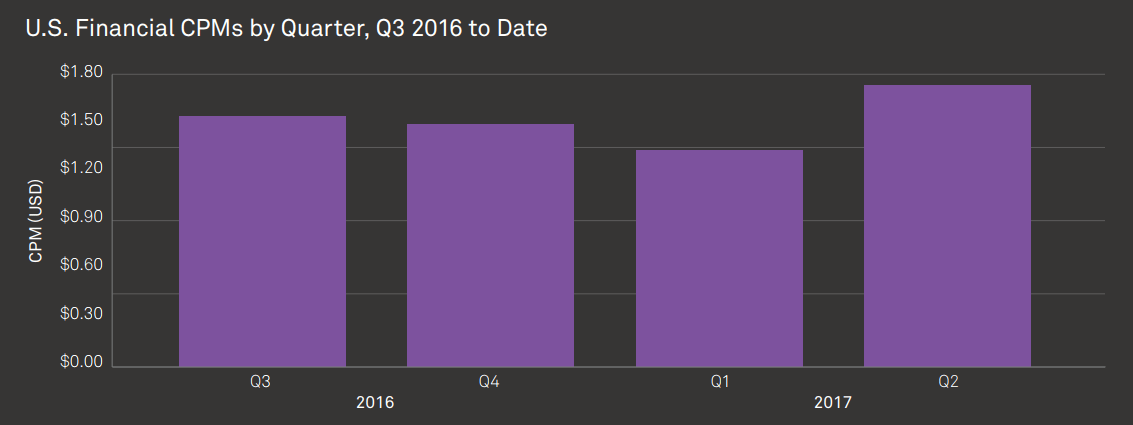

This state of affairs can last up to two to three weeks, up until February, or the whole quarter, depending on your niche and your market. The slump itself is more dramatic for some than others. In US, CPMs for retail ads are the highest in Q4 and take the deepest plunge in Q1, stabilizing by mid-February.

CPMs for most advertising categories experience similar drops (>40%). The exceptions are niches like Finance, which sees 12-20% drop in CPMs compared to the previous quarter. The category is also one of the few that are barely affected by the holiday season frenzy.

So, these are the top 5 reasons behind low CPM in January and if you’re wondering how to increase it, proceed to the next section.

9 Strategies to Increase CPM in January

Considering the fact that CPMs are pretty much dependent on supply & demand, and are seasonal, you can try a few strategies mentioned below to increase them.

1. Diversify your Ad Inventory

Diversifying your ad inventory could be an effective approach to deal with the CPM drop in Q1. Being a publisher, you have to target a wider set of audience and increase the dynamic space for ads. Moreover, it is better to integrate different types of ads (display, video, native, and audio) when incorporating a versatile publishing strategy. It will result in higher CPMs and enhance the overall publishing landscape.

2. Secure Long-term Deals with Advertisers

If possible, negotiate long-term deals with advertisers. It will add stability to your ad revenue, and you’ll be able to spend each penny without thinking about the dire consequences. Moreover, it provides a sense of reliability and commitment for both parties, which eventually helps in building fruitful relationships.

However, there can be a few drawbacks. For example, you may find adapting to the changing market dynamics a bit challenging. Apart from that, long-term deals may force you to stick to the same publishing factors, compromising with up-and-coming trends and advancements.

When it comes to choosing the right advertiser that doesn’t let you compromise with anything, relying upon programmatic advertising is the best option. It is a private auction where a publisher is free to select any advertiser that fits their requirements.

3. Build Strong Audience

As a publisher, you can focus on building a strong audience base. When an audience is loyal and engaged with your publishing, they’re able to attract advertisers. Furthermore, growing the audience base to a community will eventually increase the value of the ad inventory, resulting in higher CPMs.

4. Optimize Price Floor

Being a publisher, you must adjust your price floor according to the demand you receive. For example, if the demand is low, you must decrease the floor price. On the contrary, a price too high will force the advertisers to pass on your offer, and the only thing you’ll be left with is unfilled impressions.

Hence, you must maintain a balance, and optimize the price floor according to the demand.

5. Try Ad Refresh

Ad Refresh allows you to show multiple ads within a single page view. Experimenting with Ad Refresh is recommended when the traffic is low on your site. Moreover, it helps in boosting engagement metrics and increases the competition for ad space.

6. CMP & Page Speed

The CPM slump in Q1 also paves the way to CMP (Consent Management Platform). Using a CMP keeps you updated on online privacy regulations and even helps in boosting ad revenue.

7. Focus on SEO

Apart from ad space, you must make your website easy to navigate and quick as a flash. For that, you can improve its SEO which will include posting quality content and using relevant keywords.

8. Review Your Demand Stack

As you already know, the main reason for low CPM in Q1 is reduced demand, adding new demand at December-end may improve the numbers. In that case, partnering with specialized SSPs and retargeters that offer unique demand can increase the overall ad revenue.

Who is most affected by the CPM decrease?

Small-to-medium publishers – who sell inventory almost entirely through programmatic – bear the worst of the brunt of the Q1 slump.

“Smaller teams usually have revenue goals to meet,” says Subrat Tyagi, Customer Success and Ops Specialist at AdPushup. “The brand-name media houses can manage to draw in advertising bucks on and off programmatic platforms simply because brand marketers prioritize their inventory.”

This leaves the door open for gimmicky third-party vendors to get malicious ad codes running on websites. “We see plenty of ‘vendors’ reaching out to programmatic-only publishers this time of year offering to cut ‘direct deals’. In exchange for fixed CPMs, they provide an ad code that they insist needs to be ‘put directly on the page’. More often than not, this code turns out to be the cause of malicious redirects,” says Subrat.

Other less-experienced publishers resort to aggressive measures and inadvertently mess up their UX in order to compensate. “We have seen publishers increase their ads-to-content ratio and stack ads to jack up impression count,” says Abhinav Choudhari, Customer Success and Ops Specialist at AdPushup. “The benefits don’t tend to last, but the side effects do. In practice, these tactics destroy the UX – often irreparably – and add “skyrocketing bounce rate” to the list of publisher’s troubles.” Some media sellers may also be tempted to inflate pageviews with click farms – a practice that would have particularly disastrous consequences this year. But now publishers are becoming aware of IVT (Invalid Traffic) and fraud detection measures to prevent the waste of precious ad dollars on domains with high bot traffic.

Brand safety will be one of the decisive restraints on media buying for global/brand marketers. Publishers resorting to measures like click farms may end up losing whatever revenue they made. In more severe cases, higher than usual (5-10%) levels of IVT on the domain can get you permanently blacklisted as ‘fraudulent’ and bar your entry to top-tier demand sources.

Experts Views on Dealing with Early-January CPM Slump

We asked seasoned publishing/ad ops professionals about the best ways to maintain positive cash flow/vibes during Q1. They shared what they did during the dismal quarter, in exchange for anonymity:

“Obsessing about stacks and revenue won’t help matters,” says one dev/ops executive. “Our CPMs are 3-4 times lower in Q1 than Q4, but that’s just how the market works for our niche (going by the previous years’ patterns). We switch to house ads instead of letting malicious ads through for $0.01 CPM, and shift focus to development, testing, and optimizing.”

Now, let’s have a look at some of the strategies you can try to increase your CPM.

A sell-side programmatic executive says, “Vertical networks/ local hyperlocal agencies have seasonal high CPMs. We turn them up during our high-earning seasons and revert back to the highest-tier demand sources we have. Think Google AdSense, DoubleClick AdX, AppNexus, etc.”

“We switch to native (Taboola and Outbrain) because of their fill,” says one ad ops executive. “There’s not much else going on, so our team works on outreach to higher-tier demand sources for programmatic partnerships and agencies for direct or PG deals. Our CPMs begin to pick up after mid-January, so we just power through the first couple of weeks.“

“This is the time to look into the impact of GDPR on your publishing business,” says a UK-based publisher. “If you have a sizable EU audience, you obviously can’t leave things be. Work out the changes you’ll have to make in your front end to conscientiously collect data from European audiences. Make sure the platforms this data goes through (networks and exchanges) are GDPR compliant as well so you’re in the clear.”

The slowest season of the year is also the best time to make broader changes in site layout and hosting without fear of cinching up the revenue stream. So recuperate, test, and optimize. And above all, be patient. Before you know it, the slump will be over and your revenue will begin to pick right back up.

Frequently Asked Questions

Publishers heavily rely on advertisers’ willingness to allocate funds. In January, when advertisers face budget constraints, which leads to a notable decrease in ad spending, CPM rates experience a decline.

A general benchmark for a good CPM (Cost Per Mille) rate in 2024 is generally considered to be in the range of $2 to $10. However, actual rates can vary based on factors such as industry, geography, target audience, content type, and ad format.

Deepak has a keen eye for detail and a deep understanding of the ad tech landscape. Whether it’s through in-depth articles, thought-provoking insights, or compelling storytelling, he’s dedicated to helping people navigate the complex world of ad tech with the simplicity of his words.