Supply path optimization (SPO) is a process used by publishers to increase transparency and efficiency in the programmatic advertising supply chain. Read more!

Are you a publisher looking to maximize revenue and increase transparency in your programmatic advertising supply chain?

Supply path optimization (SPO) is a strategy that can help you achieve these goals.

By analyzing and optimizing the path through which your ad inventory is sold, SPO enables publishers to identify and work with the most effective and reputable demand sources, ultimately leading to improved revenue and a more efficient supply chain.

Some of the common questions asked by publishers about the process of supply path optimization.

- What is supply path optimization (SPO) and how does it work?

- What are the benefits of implementing SPO for publishers?

- How can publishers ensure that they are achieving revenue and efficiency goals?

- What are some common challenges or pitfalls that publishers may encounter when implementing SPO, and how can they be overcome?

- Are there any best practices or future industry trends that publishers should be aware of when implementing SPO?

Here are some statistics related to supply path optimization (SPO):

- A survey by AdExchanger found that 65% of publishers had implemented SPO or were planning to do so in the near future.

- Finally, a report by Forrester found that publishers who invest in SPO can experience a 10-15% reduction in supply chain costs and a 20-30% increase in overall programmatic revenue.

Also Read: Programmatic Advertising: A Definitive Guide For Publishers

Defining the Concept of Supply Path Optimization for Publishers

Supply path optimisation is a publisher-focused programmatic ad buying strategy to help publishers maximise their ad inventory returns.

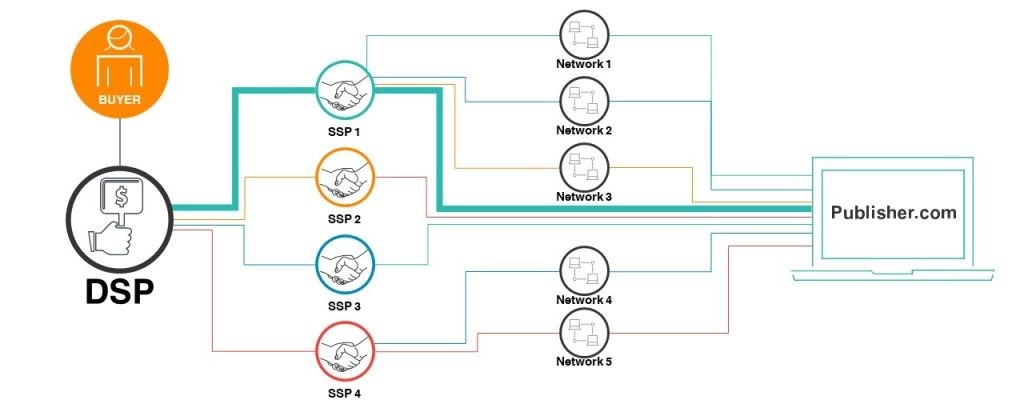

In this process, you need to analyse the data from multiple sources, namely ad exchanges, ad networks, and demand-side platforms, to optimise the flow of ad traffic from the buyer to the publisher’s inventory.

The SPO provides transparency and better control over the path of the ad traffic. In the process of programmatic auction, SPO also builds more trust between all parties.

SPO work by optimizing the path taken by ads to minimize costs and maximize the value of each impression. So publishers may increase the value of their inventory, maximize their revenue, and deliver that the right ads are being served to the right viewers.

The process of SPO includes:

- Analyzing the existing supply chain.

- Identifying the best-performing partner.

- Using data and analytics to understand each partner’s impact on the overall campaign performance.

After that, this data is used to optimize the supply chain and ensure the best possible results. By optimizing the supply path, publishers can maximize their return on investment and ensure their ads reach the right viewer.

Benefits of Supply Path Optimization for Publishers

Implementing Supply Path Optimization offers several advantages to publishers, including:

- Increased Ad Revenue: By streamlining the supply chain, publishers can ensure they receive the highest possible bids for their ad inventory, increasing ad revenue.

- Improved Ad Fill Rates: With an optimized supply path, publishers can increase the likelihood of their ad inventory filling, resulting in higher ad fill rates.

- Enhanced Transparency: SPO allows publishers to gain better visibility into the programmatic ecosystem, enabling them to identify and eliminate fraudulent or inefficient players.

- Reduced Latency: By minimizing the number of intermediaries in the supply chain, publishers can reduce page load times and improve the overall user experience.

Strengthened Relationships with Advertisers: SPO enables publishers to foster stronger relationships by directly accessing their ad inventory and ensuring their ads are displayed on the most relevant and engaging content.

Process of Implementation – Supply Path Optimization

To overcome these challenges and successfully implement SPO, publishers should consider the following these steps:

Understand your Supply Chain

The first step in implementing SPO is to gain a deep understanding of your programmatic supply chain. This includes identifying all the intermediaries involved in the buying and selling of your ad inventory.

Evaluate Intermediaries

Once you have identified all the intermediaries in your supply chain, evaluate them based on criteria such as transparency, efficiency, and performance. Consider factors such as bid density, auction dynamics, and the number of bidders.

Consolidate Intermediaries

Based on your evaluation, consolidate your intermediaries by eliminating those that are not adding value to your supply chain. The IAB recommends that publishers limit the number of intermediaries in their supply chain to no more than four.

Implement Ads.txt and Sellers.json

Implement ads.txt and sellers.json files on your website to increase transparency and reduce the risk of fraud in your programmatic supply chain.

Monitor and Analyze Performance

Once you have optimized your supply chain, monitor and analyze the performance of your demand sources. This includes tracking metrics such as fill rate, eCPM, and revenue, as well as evaluating the quality of your demand sources.

Continuously Optimize

Finally, continue to optimize your supply chain over time by monitoring the performance of your intermediaries and demand sources, and making adjustments as needed. This includes regularly reviewing and updating your ads.txt and sellers.json files to ensure that they remain up to date.

Implementing SPO can be a complex and time-consuming process, so it is important to have the right resources and expertise in place to ensure success. Consider working with a trusted ad tech partner to help guide you through the process and provide ongoing support.

Read More: What is Ads.txt? Everything You Need to Know

Challenges in Implementing Supply Path Optimization

Despite the numerous benefits of SPO, publishers may face several challenges when implementing this strategy:

The Complexity of the Programmatic Ecosystem

The sheer number of players involved in the programmatic ecosystem can make it difficult for publishers to identify the most efficient and effective supply paths.

Resistance from Intermediaries

Some intermediaries may resist the implementation of SPO, as it could potentially reduce their role or share of ad revenue in the supply chain.

Resource Constraints

Implementing SPO requires a significant investment in time, technology and expertise, which may be prohibitive for some publishers.

Limited Visibility

Publishers may lack the tools or resources to gain complete viability in the supply chain, hindering their ability to optimize it effectively.

How the AdTech’s Professionals Responding to SPO?

As the programmatic ecosystem continues to evolve, Supply Path Optimization will remain a critical strategy for publishers looking to stay ahead of the competition. In the future, we can expect to see further advancements in SPO driven by the following trends:

Embracing SPO as a Strategy

Many publishers are proactively embracing SPO as a strategy to increase transparency and efficiency in their programmatic supply chains. By optimizing their supply paths, publishers can improve the quality and performance of their demand sources, ultimately leading to higher revenue and a more effective supply chain.

Adopting SPO Best Practices

Publishers are adopting SPO best practices recommended by industry groups like the IAB and ANA. These best practices include limiting the number of intermediaries in the supply chain, implementing ads.txt and sellers.json files, and monitoring the performance of demand sources.

Investing in Internal Resources

Publishers are also investing in internal resources, such as dedicated SPO teams, to help them manage and optimize their supply chains. This can include hiring data analysts and programmatic experts, as well as investing in technology platforms to help automate and streamline the SPO process.

Balancing SPO with Revenue Goals

While SPO can help publishers increase revenue and efficiency in their supply chains, it can also lead to a reduction in the number of demand sources and potential revenue. As such, publishers are balancing their SPO efforts with their revenue goals, taking care not to eliminate too many demand sources or intermediaries that could impact their bottom line.

Also Check: Top 5 Tips for High CPM rate and Revenue Uplift by App Monetization

How SPO Contributes to Publishers Ad Revenue Goals?

Supply path optimization (SPO) can have a significant impact on a publisher’s revenue. By optimizing their supply chain, publishers can increase the efficiency and performance of their programmatic advertising and generate more revenue from their inventory. Here are some ways that SPO can impact a publisher’s revenue:

Increased Transparency

SPO can increase transparency in the supply chain by reducing the number of intermediaries and increasing visibility into the performance of demand sources. This increased transparency can lead to better decision-making and improved performance, ultimately resulting in higher revenue.

Improved Demand Source Quality

By evaluating their intermediaries and demand sources and eliminating those that are not adding value, publishers can improve the quality of their demand sources. This can lead to higher bid density, better auction dynamics, and ultimately, higher revenue.

Higher Fill Rates

By optimizing their supply chain, publishers can increase the number of available impressions and improve their fill rates. This can lead to higher revenue by reducing the number of missed opportunities and increasing the competition for their inventory.

Better Pricing

By establishing direct relationships with demand sources and negotiating better terms and pricing, publishers can improve their revenue per impression (RPM) and generate more revenue from their inventory.

Reduced Fraud and Inefficiencies

SPO can help reduce the risk of fraud and inefficiencies in the supply chain by increasing transparency and reducing the number of intermediaries. This can help publishers generate more revenue by reducing revenue loss due to fraudulent activity or inefficiencies in the supply chain.

Overall, SPO can help publishers generate more revenue by increasing transparency, improving the quality of demand sources, and reducing inefficiencies and fraud in the supply chain. While implementing SPO can be a complex process, the potential benefits to a publisher’s revenue make it a worthwhile investment.

To Summarize

Supply Path Optimization is an essential strategy for publishers seeking to maximize ad revenue and efficiency in the programmatic advertising ecosystem. By implementing SPO, publishers can streamline their supply chain, eliminate unnecessary intermediaries, and increase transparency, resulting in higher ad revenue, improved ad fill rates, and enhanced user experience.

To successfully implement supply path optimization, publishers must leverage data and analytics, collaborate with trusted partners, utilize header bidding, prioritize transparency, and continuously monitor and optimize their programmatic strategies.

As the programmatic landscape continues to evolve, publishers that embrace SPO and stay ahead of emerging trends will be well-positioned to capitalize on the growing opportunities within the digital advertising space.

By optimizing your programmatic supply path, you not only enhance your ad revenue potential but also foster stronger relationships with advertisers and improve the overall quality of your ad inventory.

With the right approach and a commitment to continuous optimization, supply path pptimization can drive significant value for publishers in the ever-changing world of programmatic advertising.

AdPushup helps publishers with the supply path optimization, as well as bring maximum revenue benefit without harming the user experience. Start here.

FAQs

SPO relies on data from multiple sources, including DSPs, SSPs, ad networks, and exchanges. This data determines the most efficient and cost-effective path for delivering ads.

Publishers analyze the path media buyers (advertisers and ad agencies) take to purchase their inventory in demand-path optimization (DPO). Publishers use DPO to identify areas of the media-supply chain that are working well for them and those that could be optimized.

The best way to optimize your supply path is to use a supply path optimization platform. This platform will analyze data from multiple sources and generate insights that can help you determine the best path for delivering ads.

When optimizing the supply path, you should consider latency, price, performance, and reach factors. By looking at these factors, you can determine the most efficient and cost-effective path for delivering ads.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.