As a publisher, your ad inventory pricing strategy can make or break your revenue optimization efforts. To get the most out of your ad inventory, you must know how to set the floor price wisely. Here’s all you need to know.

The floor price, although frequently overlooked, is a vital aspect for numerous publishers. The intricacies of this concept are often underestimated, but understanding its significance can unlock significant financial gains for publishers. While its importance may not always be immediately apparent, it is the bedrock for generating significant revenue.

But Why Does Floor Price Matter?

By setting a reasonable floor price, publishers can establish a solid foundation for their ad inventory to generate substantial revenue.

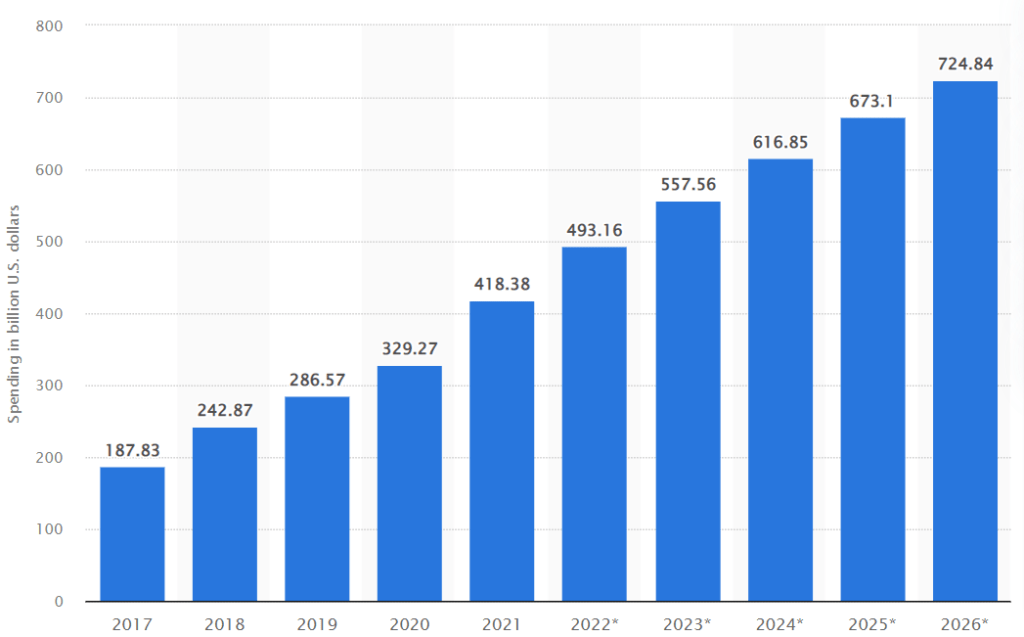

In fact, programmatic advertising reached a whooping 418 billion U.S. dollars in 2021, which is estimated to reach an impressive 725 billion dollars by the year 2026.

Thus, as a publisher, you should maximize the potential of your ad inventory, and understand the intricacies of the price floor to achieve this goal.

So before we delve into the nitty-gritty of price floor setting, let’s quickly understand what floor price means?

What is a Floor Price?

Price floors let buyers in a programmatic auction know they won’t be able to buy an impression cheaper than the set price.

So, if you set up a price floor of $5 and receive the following bids: $4, $5, $6, and $7, then only the last two bids will be considered because you have eliminated everything else with your price floors.

Publishers set price floors to ensure that their inventory is not undersold.

But what if the bid is slightly lower than the price floor? Will it still be considered?

Yes, that’s when the role of a soft floor comes into the picture. And this takes us to our next discussion, “types of floor price”.

How Does Floor Price Work?

Gone are the days when ad inventory was passed to another ad network when the first ad network could not meet the floor price. Nowadays, publishers are not relying on the waterfall system anymore. With real-time exchanges and header bidding, networks that bid below the minimum price are rejected. Only those bidding at or above the minimum are considered.

Setting the price floor is essential for maximizing publisher revenue. However, many publishers are too busy with other tasks, like creating content, to constantly adjusting it. So, they often change the floor price periodically, like weekly or monthly, in collaboration with their partners.

To address this need, ad tech companies optimize the price floor using data. They analyze how much advertisers or networks would pay for a publisher’s ad impression and set the floor accordingly. Prices can vary based on weekdays versus weekends or day versus night. An automated process constantly adjusts the floor to achieve the highest possible yield.

Also Read – AdPushup Insider: The Relation Between Price Floor Optimization and Geography

Types of Floor Price

There are three types of floor prices, let’s have a quick look.

Soft Floor

When the bid is slightly lower or around the set floor price by the publisher and is still considered by the advertisers, it is called a soft floor. Accepting soft floors is common among publishers because many prefer to generate some revenue rather than nothing.

Hard Floor

On the flip side, a hard floor is a floor price where publishers accept no bid lower than the price they set. This approach ensures that the publisher maintains complete control over the value and worth of their ad inventory.

Dynamic Floor

Dynamic price floors automatically adjust based on demand partners’ historical performance. But, publishers shouldn’t set and forget them. They must monitor and optimize the floor value as programmatic demand channels change. This ongoing process maximizes revenue potential and maintains a competitive edge.

Let’s now get to the heart of the matter and take a look at the factors you should consider while setting a floor price for your ad inventory.

What to Consider When Setting Floor Price?

To make the most of your ad space in terms of revenue, there are certain factors you should take into account while setting a floor price. Let’s have a look.

Country

This is one of the most common parameters that publishers use to set floor prices. If you are a publisher with both Indian and US traffic, you would ideally want to start with running higher floors on the US inventory (where advertisers are willing to pay more) as compared to the Indian inventory (where CPMs can be as low as $0.01 in some cases).

Device

Let’s take the example of a pizza brand. If you are in the vicinity of a local pizza outlet (and they can track that via your mobile device location turned on), there is a high chance that they will be willing to pay more for you on mobile devices. Alternatively, if you are a B2B company, and there is little chance someone will end up directly buying your product via mobile, floor prices for desktops can be higher.

Day Parting

Most retailers who run stores prefer spending only during the hours their store is actually open. If you have the kind of inventory that these stores can target, it makes sense for you to actually raise the floor during the store opening time and reduce these once the store closes.

Seasonality

It is known that seasonality affects CPMs and publisher revenues. If you are a publisher in India creating content that helps audiences fill up taxes, you know that the period around the end of Q1 is something you can target where most advertisers will be willing to pay more.

Even if you do not have a niche website, you can still try out things like increasing floors around Christmas (when advertisers are willing to pay more and exhaust their budgets).

Also Check – How to Manage Seasonality? Revenue Optimization Tips for Publishers

Audience

If you are a news website that has different sections for Sports and Politics, you can leverage these audience sets to be targeted by different kinds of advertisers. During the Super Bowl, it is best to raise floor prices on the sports section, but during the US presidential elections, raising prices on the Politics section will drive results.

Ad Size

This is the lowest-hanging fruit of them all. There are certain sizes of ad units that tend to work better for some kind of publishers in terms of buyer (DSP) demand. If for example, your 300×600 ad unit is outperforming the square 300×250 ad unit on average, it is advisable to set higher floors on the vertical unit as compared to the latter.

Also read: Best Price Floor Optimization Partners to Increase your ADX Revenue

How to Set Floor Price? Manual vs. Automated

All of this seems good on the surface but requires a lot of commitment in terms of man-hours. Someone has to continually monitor the bid ranges through a period of time to move the needle on price floors and all of this has to be incremental in nature (it makes no sense for you to set the floor price as $10 if on average your bids end up in the range of $2-$5).

How do you go about doing this if not manually? You can do it with Dynamic Price Floor Optimization (DFO) provided by some vendors. DFO allows you to determine the market demand for a particular audience in a particular time frame and price it optimally.

DFO also automatically sets price floors, for instance, in your AdX based on calculations of factors mentioned above. These calculations and the speed of reaction (ability to quickly adjust prices) are the core of Dynamic Price Floor Optimization.

Whether you try to do it manually or end up taking the help of a vendor, it is best if you fetch the bid ranges reports from time to time to get a better idea of where exactly is that most of the bids are being won/lost. Another important thing is to always set up some passback tags (the tag the impression passes to in case no DSP is able to match the floor price mentioned) to make sure none of the impressions go unsold.

Although a process that will not produce results overnight, floor prices have always been a go-to strategy for most big publishers, and most often than not, they end up reaping rewards in the long run if done right.

Top Factors that Impact your Floor Price

Ad conversion

The value of an ad isn’t just about how many people see it; it’s about how many people do something because of it, like buying something or signing up for something. Thus, a high conversion rate spells success for both publishers and advertisers, ensuring mutual benefit and satisfaction.

Ad Placement

The location and prominence of the ad space within a webpage or app can influence its value. Ads placed in more visible or prime positions typically command higher floor prices.

Ad Unit Competition

Next, when your ad unit is able to attract more and more advertisers, the floor price is going to be higher. Thus, for an unit to attain a higher floor price, publishers need to have more advertisers interested in showing their ads. If that’s not the case, the minimum price you can charge might be lower compared to when many advertisers want to show their ads there.

Ad Viewability

When it comes to online advertising, the key is visibility. The more exposure your ads get, the higher the chances of potential customers seeing them. To expand your reach and connect with a broader audience, it’s essential to increase your ad placement across various platforms and channels.

Final Words

Optimizing price floors does not have a one-size-fits-all solution. It requires continuous monitoring and analysis of demand channels. It is advised for publishers to avoid making drastic changes to the price floor. Instead, take things easy and make small adjustments by cents from time to time. It can be made based on an analysis of average CPMs from demand partners. If you need guidance on where, to begin with, optimization or have any questions, please don’t hesitate to reach out to us.

AskAdOps is a weekly column in which Shubham Grover, Product Specialist at AdPushup, answers commonly asked questions about ad operations. If you have a question, send in an email at askadops@adpushup.com

Frequently Asked Questions: Floor Price

In the world of advertising technology, price floor refers to the minimum price set for the ad inventory by a publisher, below which it will not be sold.

One example of a floor price can be premium digital advertising placement on a popular news website. The publisher sets a floor price of $10 per thousand impressions (CPM). This means that advertisers interested in displaying their ads on this prime ad space must bid at least $10 for every thousand impressions, ensuring that the publisher receives a minimum revenue for the inventory.

As mentioned, it is the minimum price set for an ad space, below which it will not be sold.

Now, as the name suggests itself, the selling price is the actual price at which a product or service is sold to customers.

Deepak has a keen eye for detail and a deep understanding of the ad tech landscape. Whether it’s through in-depth articles, thought-provoking insights, or compelling storytelling, he’s dedicated to helping people navigate the complex world of ad tech with the simplicity of his words.