Get a primer on types of Programmatic Deals (open auction, private auction, preferred deal, and programmatic guaranteed deal), their advantages and disadvantages.

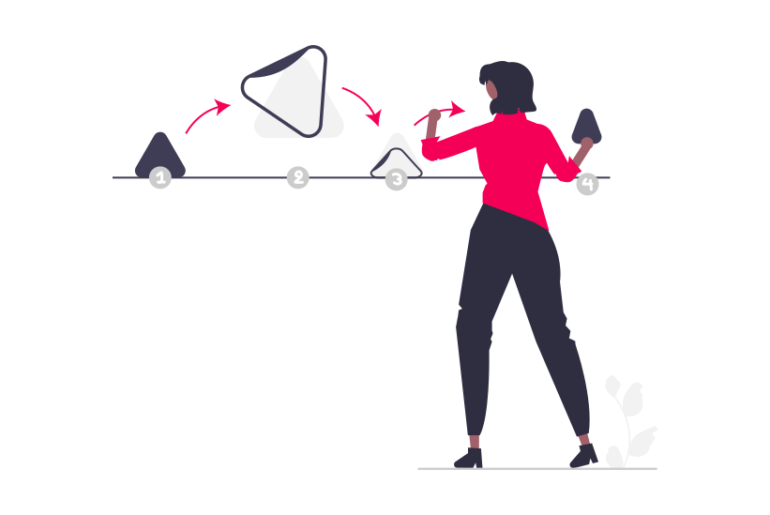

Each impression is unique, then why trade them equally?

With advancing technology, publishers have multiple methods to sell their inventories now. Think of a mode of trade and ad tech possibly offers that for inventory exchange. Just like the stock market, digital inventories are also sold in bulk, open-source, and privately.

In order to help, we present you with four types of programmatic deals with their potential advantages and disadvantages for publishers.

Also Read: Programmatic Advertising: A Quick Guide For Publishers

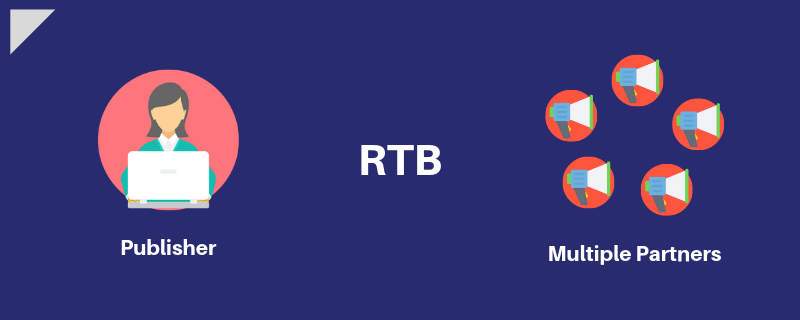

Open Auction (Real-Time Bidding)

- Also known as Open exchange, open marketplace, real-time bidding

- Participation: All (eligible) buyers on a platform

- Priority: Ad servers set RTB at the lowest priority

Open Auction or RTB is exactly what it sounds like. Publishers take a part of their inventory to the open market for multiple demand partners to bid on it.

It might sound chaotic; however, RTB is managed in a controlled environment. Publishers are allowed to choose the specific ad units to be placed for the open auction. Next, they can block advertisers and filter ad types as per their requirements. And most importantly, they get to choose the floor price for their inventory.

Similarly, buyers are allowed to set up a campaign before the actual bidding starts; this saves them time and helps them improve on the targeting front of the business.

Recommendation: Publishers are advised not blindly put their ad units for open auction. Ideally, remnant inventory is best handled by real-time auction.

Here are some pros and cons of an open auction that you should know:

Pros:

- Ideal for Remnant Inventories: As mentioned above, the open auction is a great way for publishers to deal with a remnant inventory. RTB makes a wide range of advertisers available, basis on the filters set by publishers, they can find varied demand and get a good price for unsold ad units.

- Quick Setup: Unlike other programmatic methods, the open auction takes less hassle and optimization steps to set up. You just need to select ad units, choose floor price and add further criteria for auction and you are all set. Moreover, it doesn’t ask for deal ID; saving sell-side and buy-side multiple steps of authentication.

- Easy Optimization: Real-time auction is fast-paced. Once set, you can see bids coming in almost instantly. Furthermore, it avails you to make changes to the setup anytime you want.

- Control Over the Inventory: Even in the case of RTB, publishers want control over their inventory all the time. This control includes what types of ad creatives are being placed, who can check the details of the inventory and what type of targeting is allowed.

- Unlimited Revenue Potential: Demand is not going to dry up on open exchanges. There may be seasonal downfalls, but otherwise, the revenue remains steady.

- Niche Advertisers: For newer publishers with niche content and too few pageviews to be sold on a niche-specific network, open auctions can help find relevant advertisers in a global market.

- Unsegmented Audience: Open auctions maximize yield for sites where the audience is a blend of demographic characteristics, and there is no unique value of either the visitors or content. Sites like these benefit from DSPs’ targeting strategies, which enhances the value of impressions for buyers.

Cons:

- Data Leakage: In the case of RTB, the bid is available for varied advertisers to bid on; this increases the chance of data leakage. A bid request stores a lot of data like publisher details and user demographics (cookie data). However, now we have data policies (GDPR and CCPA) and security measures to protect users from such malpractice.

- No Deal Guarantee: If the floor price is too high and/or inventory is not relevant for the available demand partners, it can still go unsold. In such a case, publishers are advised to carefully evaluate the value of inventory before deploying it in the market.

- Low Overall eCPMs: Compared to other programmatic channels, open exchanges have a much larger supply of impressions. This oversupply gives control to buyers and often returns low eCPMs to publishers.

- Malicious Ads: In an open marketplace, your inventory is not only available to varied advertisers but also to attackers. They keep an eye on vulnerable inventories and push their malicious creatives once they get a chance. Pinpointing the source can be difficult, thanks to media arbitrage and transparency issues.

Private Auction

- Also known as: Closed auction, private marketplace, invitation-only auction

- Participation: only invited buyers are allowed

- Priority: Ad servers place private auctions at a higher priority than open auction

PMP is an invitation-only real-time auction. Publishers send an invite to various advertisers and demand partners to place their bids on the available inventory.

The invitation-only process makes the deal safer than the open auction. Publishers invite only trusted demand partners for the auction. PMP inventory is labelled ‘premium’ and offers differentiated ad inventory packages (built around audience data, impression attributes, content type, and more) to a group of buyers pre-approved by the publisher.

Mandatory use of Deal ID: In a private auction, deal ID is mandatory and used to identify the seller and buyer during the auction. It is a unique string of characters defining things like priority, transparency, floor pricing, or data (depending on the platform you’re using). It is assigned to the inventory package, which allows it to be purchased programmatically through a DSP.

Pros:

- Transparency: Thanks to deal ID, sellers and buyers are able to identify each other at the point of the exchange. Buyers know what type of inventory they are getting. And sellers know who is placing ad creatives on their sites/apps.

- High CPM: Two factors make private auctions more profitable; premium inventory and chosen advertisers. Premium inventory has higher viewability and user involvement. And chosen advertisers are willing to pay in good numbers for such placements. Hence, leading to comparatively better CPM for publishers.

- Fraud Prevention: Since the publisher and seller are directly in a deal, there is less chance of fraud, ensuring the safety of user data.

- Automated: It’s not plug-and-play like an open auction, but PMP deals are still automated among DSPs and SSPs, which means they’re less labour-intensive than direct sales.

- Better Buyer Relationships: Publishers and buyers can negotiate the terms and agree according to their mutual understanding. This gives them time to build strong relationships resulting in a beneficial exchange between the two parties.

Cons:

- Difficulty Maintaining High-Quality Inventory: Advertisers will only agree to a good price if they find your inventory ‘premium’ enough. Otherwise, you might end up negotiating at a lower price. It may be difficult to maintain a high enough fill rate to surpass open auction revenue.

- Miss out on opportunities: It is possible that some high-paying advertisers don’t get to make it to the list of publishers because of a lack of information on the publisher side.

Preferred Deals

- Also known as: Spot buying, private access, unreserved fixed rate

- Participation: One buyer

- Priority: Ad servers put preferred deals over the private and open auction

Within the private marketplace, buyers participate in the deal with ‘first look’ criteria and then decide to buy it or not. Meaning before making any promise to purchase the inventory, the buyer is first allowed to check the inventory to see whether it matches the buyer’s requirements or not.

Essentially, at the cost of a pre-negotiated fixed price, the buyers get priority and exclusive access to inventory before you make it available to everyone else in private and then open auctions.

The number of impressions is not guaranteed, but the audience is. Since buyers’ DSP can use their audience data to review every ad impression before they decide to buy it.

Also Read: Preferred Deal: Pros, Cons, and How to Set it up in GAM

Pros:

- Highly Targeted Ads: Impressions won in preferred deals are shown to very specific audiences enriched by DSP data, making it more relevant to your visitors.

- Better Buyer Relationships: Buyers reach out directly to publishers for the first-look privilege and price negotiation. Negotiation and speculation make parties build rapport.

- Creative Control: Publishers can review and approve the campaign creatives beforehand.

Cons:

- Low Fill Rate: Buyers have the liberty to cancel the subscription anytime. If that happens, inventory will directly go to the open auction. For this reason, it’s important to price and segment the inventory appropriately.

- Downfall Risk: With less competition, the impressions bought in preferred deals may get sold at a lower price.

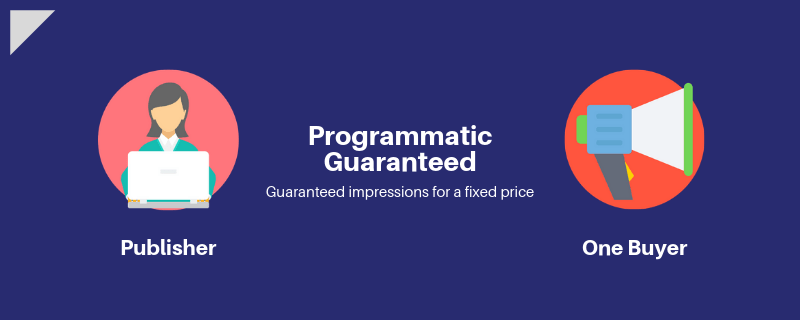

Automated Guaranteed

- Also known as: Programmatic guaranteed/direct / premium / reserved

- Participation: One buyer

- Priority: Highest ad server priority

Programmatic or automated guaranteed is where the premium inventories are exchanged. The publisher chooses one buyer and guarantees a number of impressions for a fixed (negotiated) price.

As the seller and buyer deal directly, it eliminates the chances of fraud. Next, for a fixed number of impressions, publishers get a good price for their inventory. And in the long run, publishers get to make better relationships with demand partners.

Programmatic guaranteed is different from direct deals. In direct deals, publishers keep control of inventory and present what they want to sell. However, in programmatic guaranteed, buyers are allowed to see all placements and choose as per their requirements.

Pros:

- Effective Use of Premium Inventory: Ad units with high user engagement and less banner blindness ought to be sold efficiently by publishers. This is where programmatic guarantees can help get a reasonable profit from the efforts of the publisher.

- Transparency and control: One-on-one dealing ensures control for the sell- and buy-side. Both parties are free to approve/disapprove inventory or creatives. Because of this, parties can deal comfortably.

- Creative control: Direct dealing creates an opportunity for publishers to ask for creative reviews before the deal signing.

Cons:

- Underselling: Despite negotiating for highly valuable inventory served at top priority, publishers can’t accurately account for targeting parameters on the buyer side and/or viewability, which could lead to underpricing.

- Resource-intensive: Although everything is ‘automated’, publishers still need ad ops resources to make sure the campaign is executed as required.

Also Read: Programmatic Deals vs. Direct Deals

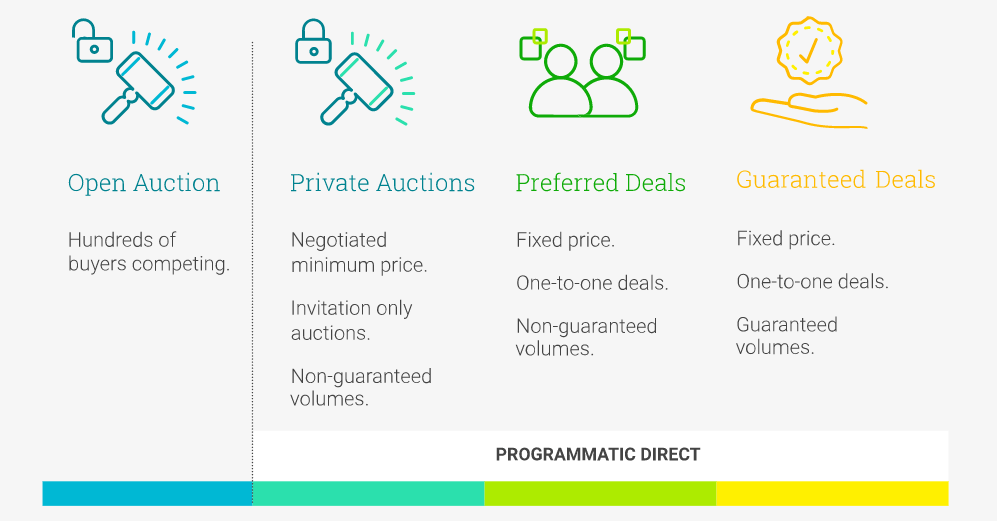

Summary of Features:

| RTB | PMP | Preferred Deal | Programmatic Guaranteed | |

| Auction | Yes | Yes | No | No |

| Buyer | Multiple | Multiple | One | One |

| Ad Server Priority | Lowest | Above RTB | Above PMP | Highest |

| Impressions Guaranteed | No | No | No | Yes |

| Negotiation | No | Minimum | May or May not | Yes (pre-deal negotiation, then fixed price) |

Publishers can build a sustainable advertising-based publishing business with a stronghold on both direct and automated selling. Knowing how to trade your inventory will allow you to fetch higher rates for your inventory and potentially strengthen relationships you use for manual direct selling once you’re competent enough.

FAQ

The programmatic deals types for publishers are:

1) Open Auction RTB programmatic deal

2) Private Auction

3) Preferred Deal

4) Automated Guaranteed

Programmatic Direct Deal allows publishers to negotiate both Programmatic Guaranteed and Preferred Deal in Ad Manager.

Programmatic Guaranteed is when a buyer negotiates a price for inventory that’s reserved for a buyer. The Preferred Deal is when the buyer negotiates a price for inventory that the buyer can optionally buy.

Shubham is a digital marketer with rich experience working in the advertisement technology industry. He has vast experience in the programmatic industry, driving business strategy and scaling functions including but not limited to growth and marketing, Operations, process optimization, and Sales.